Are you curious about your credit score? Wondering how it stacks up against the rest of the population? Look no further. In today's fast-paced and financially complex world, it's crucial to know where you stand financially. Luckily, checking your credit score is easier than ever before – and even better, many services offer free checks. Join us as we explore the importance of a good credit score, how to check yours for free and what steps you can take to improve it. Get ready to take charge of your finances with a little help from our guide on free credit scores.

About Free credit score

Your credit score is a number that reflects the information in your credit report. Lenders use your credit score to help them decide whether to give you a loan and how much interest to charge you. A higher credit score means you're seen as a lower risk, which could mean you're more likely to be approved for a loan with a lower interest rate.

A good credit score can also help you get discounts on things like auto insurance and utilities and it can make it easier to rent an apartment or get a cell phone plan.

You can get your free credit score from many sources, including some banks and credit card issuers. You can also buy your FICO® Score from myFICO.com.

Why is it important to have a good credit score?

Credit scores are important because they show how likely you are to repay debt. A high credit score means you're a low-risk borrower, which could lead to better interest rates and terms on loans. Conversely, a low credit score could make it difficult for you to borrow money or qualify for favorable loan terms. That's why it's important to keep an eye on your credit score and take steps to improve it if necessary.

Here are a few things you can do-

1- Make all of your payments on time. This includes your mortgage, car loan, credit cards, etc.

2- Keep your balances low. High balances can hurt your credit score, even if you're making all of your payments on time.

3- Check your credit report regularly for errors and dispute any inaccuracies you find. You're entitled to one free credit report per year from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion). You can get yours by visiting www.annualcreditreport.com.

How to check your free credit score

It's important to stay on top of your credit score, especially if you're looking to make a major purchase like a car or a house. You can check your credit score for free with a number of different websites and apps.

To get started, simply go to one of the following websites and enter your personal information-

1- Credit Karma

2- Credit Sesame

3- Quizzle

Once you're signed up, you'll be able to see your credit score and credit report. Be sure to check back regularly to see if there are any changes or discrepancies. If you see anything that doesn't look right, you can dispute it with the credit bureau.

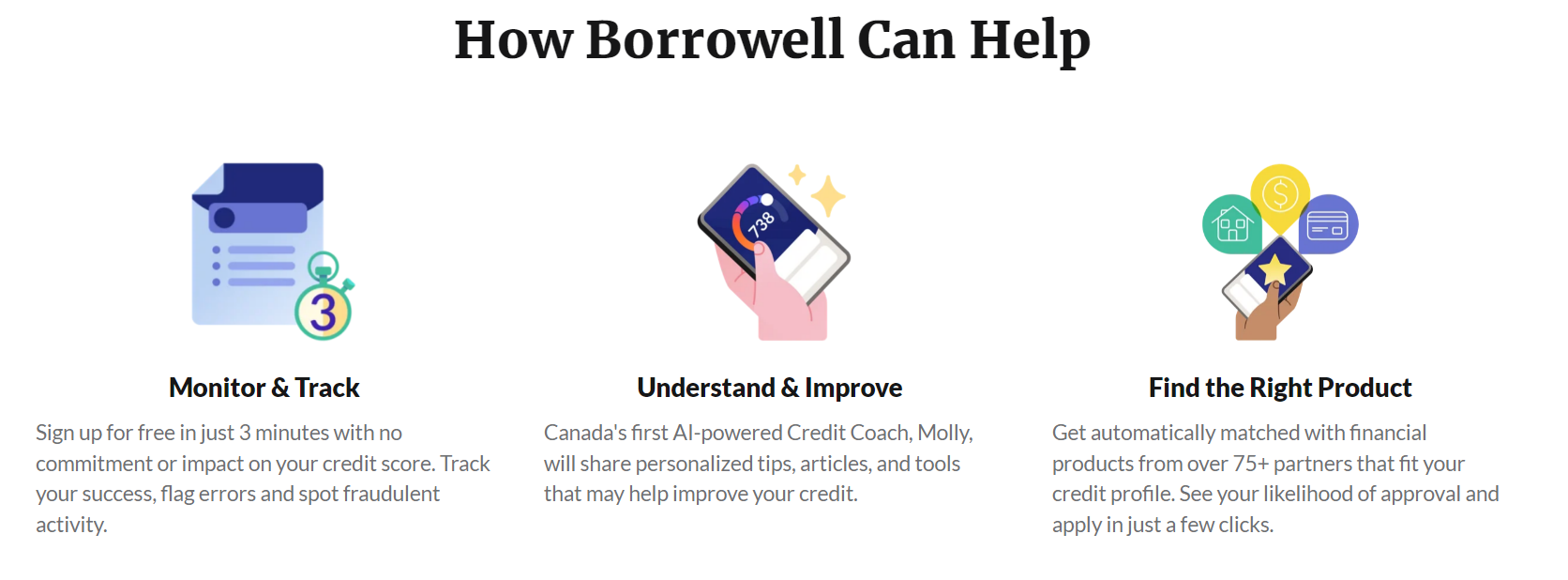

How to monitor and track your finances

It is important to keep track of your spending and saving habits in order to maintain a healthy financial life. There are many ways to do this, including creating a budget, using a financial tracking app, or simply writing out your expenses.

One way to monitor your finances is by creating a budget. This will help you see where your money is going each month and where you can cut back on spending. To create a budget, start by listing all of your income sources and then track all of your expenses for one month. Once you have this information, you can begin to categorize your spending and figure out where you can save money.

Another way to keep track of your finances is by using a financial tracking app. These apps can be used to track your spending, set budgets, and even give you insights into your financial habits. Some popular financial tracking apps include Mint, YNAB and Wally.

Finally, another simple way to monitor your finances is by writing out all of your expenses for one month. This can be done in a notebook or on a spreadsheet. Simply track every penny you spend for one month and then review where most of your money is going. This method may not be as detailed as using an app or budget, but it can still give you a good overview of where your money goes each month.

Build credit with your rent

If you're looking to build credit but don't have a traditional credit card, you can use your rent payments to help. There are a few different ways to do this.

One option is to sign up for a service like RentTrack or Rental Kharma. These companies report your rental payments to the credit bureaus, which can help boost your score.

Another option is to set up automatic payments with your landlord or property management company. This way, your rent will always be paid on time and will show up on your credit report as such.

Building credit with your rent is a great way to improve your score without taking on any additional debt. Just be sure to keep up with your payments and stay on top of your other financial obligations, as missed payments can damage your score just as much as late ones.

Find tools that may help improve your credit.

If you're trying to improve your credit score, there are a few different tools that may be able to help you. One tool is a credit monitoring service, which can help you keep track of your credit report and score. Another tool is a credit counseling service, which can help you develop a plan to improve your credit.

Concluding By

Taking advantage of free credit scores can be a great way to make sure your finances are in order. You'll be able to see all the information that matters and make sure any mistakes or discrepancies that may have been made on your accounts are taken care of. With free credit scores, you can easily monitor how well you're doing financially and address any issues as soon as they come up. This will help ensure that you have a good handle on your financial situation, so get started today by getting your credit score checked for free.

Thanks For Reading..!!