Are you looking to take your credit score to the next level? If so, you may be wondering which platform is best suited for managing your financial health: Borrowell or Credit Karma. These two leading platforms offer free credit monitoring services and other features that help consumers build their credit profiles. But which one should you choose? In this post, we'll dive into a detailed comparison of Borrowell vs Credit Karma to help you determine which platform is right for you. So buckle up and get ready to learn all about these powerful tools – let's dive in!

Borrowell: Simplifying Personal Finance

Borrowell is a Canadian financial technology (fintech) company that is dedicated to making personal finance simple and accessible for everyone. Founded in 2014, the company has quickly become one of the leading fintechs in Canada, offering a range of financial products and services to help Canadians better manage their money.

The company's mission is to empower Canadians to improve their financial well-being by providing free credit scores, personalized recommendations, and low-interest loans. Whether you're looking to consolidate debt, renovate your home, or simply improve your credit score, Borrowell has a solution for you.

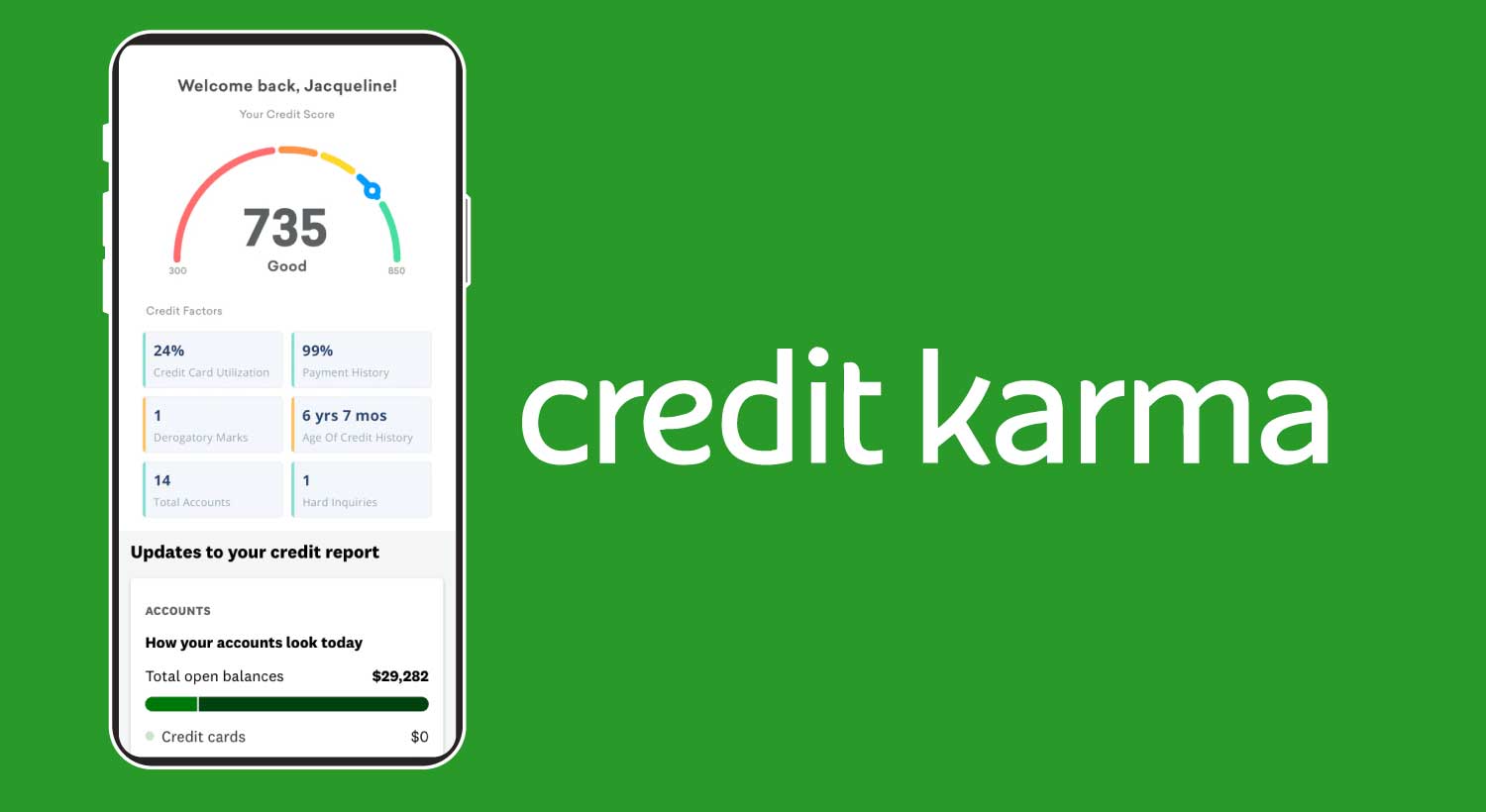

Credit Karma Overview

Credit Karma is a personal finance company that was founded in 2007. The company offers a range of services to help people improve their credit scores and manage their finances. Credit Karma provides free credit reports, credit scores, and credit monitoring services to its users. The company also offers financial calculators, educational resources, and credit card recommendations.

Credit Karma's main service is its free credit score and credit report monitoring. Users can sign up for a Credit Karma account and receive updates on their credit scores and reports on a weekly basis. The platform also offers credit score simulators, which allow users to see how certain actions, such as paying off a credit card or opening a new account, might affect their credit score.

Borrowell vs Credit Karma: Personal Loans

When it comes to personal loans, Borrowell has a few advantages over Credit Karma. Here are some reasons why:

- Loan Options: Borrowell offers a wider variety of loan options than Credit Karma. While Credit Karma only offers personal loans, Borrowell offers personal loans, home equity loans, and mortgage refinancing.

- Lower Interest Rates: Borrowell generally offers lower interest rates on personal loans than Credit Karma. Borrowell's interest rates start at 5.99%, while Credit Karma's interest rates start at 6.95%.

- Credit Score: Borrowell offers free credit scores and credit monitoring services, just like Credit Karma. However, Borrowell's credit scores are provided by Equifax, which is one of the two major credit bureaus in Canada. Credit Karma provides credit scores from TransUnion, which is the other major credit bureau.

- Fast Approval: Borrowell offers fast approval times for personal loans, with many borrowers receiving their funds within 48 hours of applying. Credit Karma, on the other hand, does not specify how long it takes to receive loan funds.

Overall, while both Borrowell and Credit Karma offer personal loans, Borrowell has an edge due to its wider variety of loan options, higher loan amounts, lower interest rates, and credit scores provided by one of the major credit bureaus in Canada.

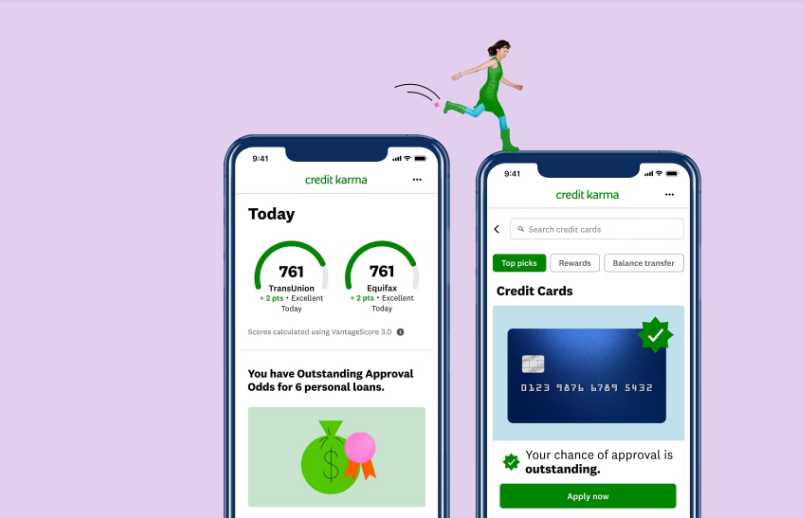

Borrowell vs Credit Karma: Credit Score Monitoring, Reporting & Improvement

Borrowell and Credit Karma both offer free credit monitoring services that allow users to check their credit score and receive alerts if there are any significant changes. Both platforms use TransUnion, one of the two major credit bureaus in Canada, to provide credit scores to their users.

In terms of credit score reporting, both Borrowell and Credit Karma provide users with access to their credit reports, which can be helpful in identifying any errors or fraudulent activity. Borrowell provides users with access to their credit reports from Equifax as well as TransUnion, whereas Credit Karma only provides credit reports from TransUnion.

When it comes to credit improvement services, Borrowell and Credit Karma both offer personalized recommendations on how to improve credit scores. Borrowell provides users with a credit report analysis, which identifies areas where they can improve their credit score. Borrowell also offers a Credit Coach service that provides personalized guidance on how to improve credit scores.

Borrowell vs Credit Karma: Fees & Cost

while the core services of Borrowell and Credit Karma are free, there may be additional services or features that come with a cost. For example, Borrowell offers a premium service called “Borrowell Boost,” which allows users to add utility and telecom bill payments to their credit report, potentially increasing their credit score. This service costs $9.99 per month. Borrowell also partners with lenders to offer loans and credit cards to users, but the interest rates and fees associated with these products are determined by the lender and not by Borrowell.

Credit Karma offers a similar premium service called “Credit Karma Premium,” which provides additional features such as credit monitoring from Equifax, personalized advice from a certified financial planner, and access to identity theft insurance. This service costs $9.99 per month.

Borrowell vs Credit Karma: Customer Support

Borrowell and Credit Karma both offer customer support through their websites and mobile apps. Users can typically find answers to common questions through the platforms' help centers, which contain articles and FAQs on topics such as credit scores, credit reports, and personal finance. In terms of direct customer support, Borrowell provides users with several options to get in touch with a representative. Borrowell's customer support team is available via email, phone, and live chat, and they typically respond to inquiries within 24 hours. Borrowell also has a dedicated support center for its premium members, who receive priority support.

Credit Karma also provides customer support via email and phone, but their support team is not available through live chat. Some users have reported longer wait times when contacting Credit Karma's customer support, but this may vary depending on the nature of the inquiry.

Final Verdict

In conclusion, both Borrowell and Credit Karma offer valuable services that can help users monitor, understand, and improve their credit scores. The choice between the two platforms ultimately comes down to personal preference and the specific features that you are looking for. Borrowell may be a better option for those who want a more comprehensive credit report with additional details and a free Equifax credit report once per year. On the other hand, Credit Karma may be a better option for those who want more personalized credit improvement recommendations and access to credit card and loan offers.

Ultimately, it's a good idea to try out both platforms and see which one works best for you. Both Borrowell and Credit Karma are free to use, so there's no harm in signing up for both and comparing their features and services.