Looking for a reliable, hassle-free way to manage your finances? Look no further than Borrowell! Whether you're looking to refinance your debt, get a loan or simply keep tabs on your credit score, this innovative brand has got you covered. But what makes Borrowell stand out from the competition? In today's blog post, we'll be taking an in-depth look at everything this comprehensive financial platform has to offer. From its intuitive user interface to its cutting-edge technology and top-notch customer support, we've got all the details you need to decide if Borrowell is right for you. So let's dive in and explore the world of borrowing with Borrowell!

Brand Overview

Borrowell is a Canadian financial technology company that was founded in 2014 with a mission to help Canadians make better financial decisions. The company offers a range of financial services, including free credit score monitoring, personal loans, and credit cards.

Borrowell has quickly become a popular choice for Canadians who are looking for a reliable and trustworthy financial partner. With their user-friendly platform, competitive rates, and commitment to transparency and customer education, Borrowell has established a reputation for providing high-quality financial services.

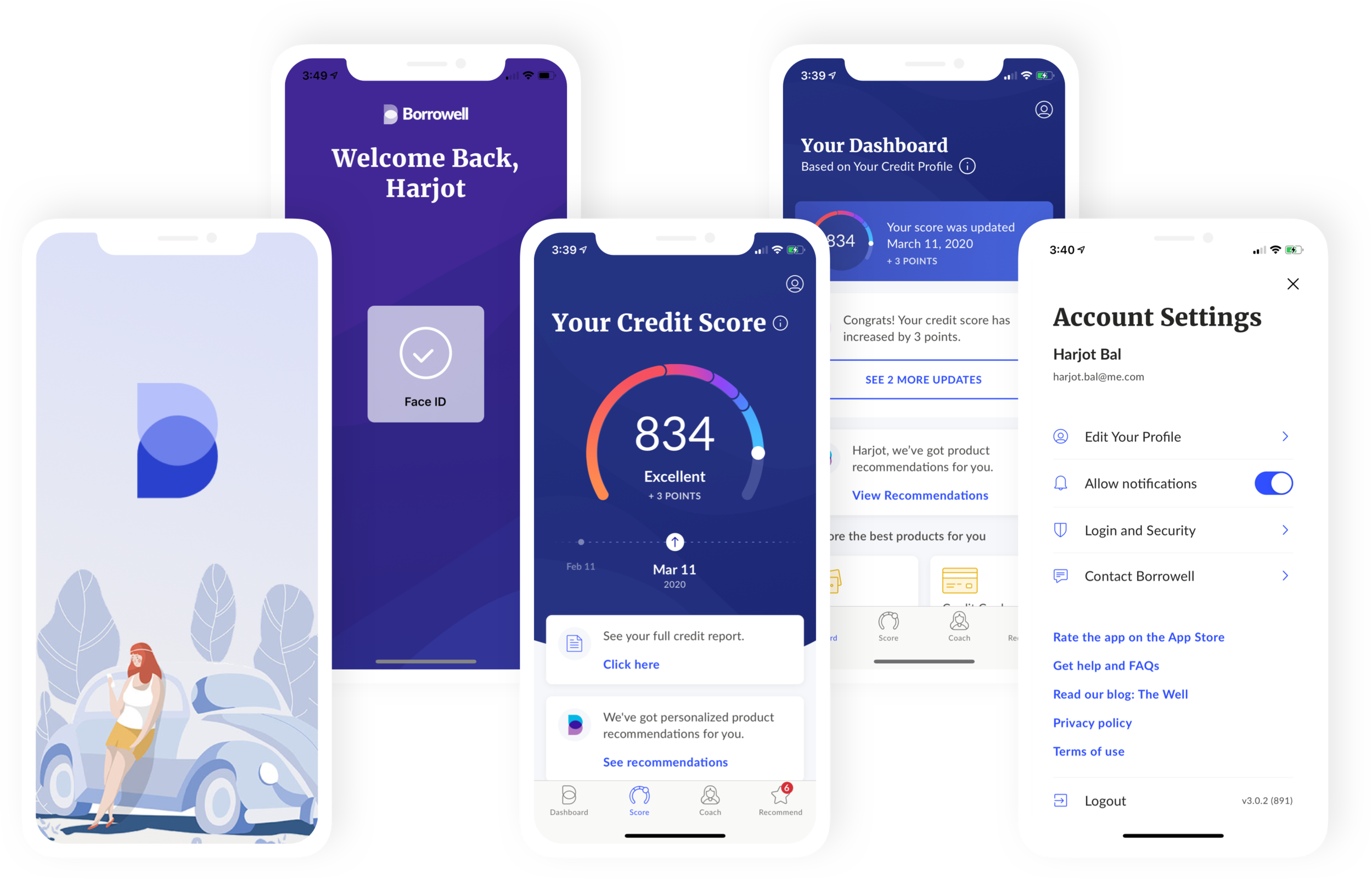

User-Friendly Online Platform

The platform is designed to be user-friendly and easy to navigate, with clear instructions and prompts to help customers complete tasks quickly and easily. The platform is also available as a mobile app, which makes it easy for customers to manage their finances on-the-go. With the app, customers can access their account information, check their credit score, and make payments with just a few taps on their smartphone. Additionally, Borrowell's online platform provides customers with personalized financial advice and resources to help them improve their financial literacy and make better financial decisions. With its intuitive design and wealth of useful features, Borrowell's online platform is a major selling point for the company and a key reason why many Canadians choose Borrowell for their financial needs.

Competitive Rates and Flexible Repayment Options

Borrowell offers competitive interest rates on their loans, which can be a major advantage for customers who are looking to save money on interest charges. In addition to competitive interest rates, Borrowell also offers flexible repayment options that can help customers manage their debt more effectively. Borrowell's loans are typically repaid over a period of 3-5 years, but customers can choose to pay off their loans early without incurring any penalties.

Borrowell also offers the option to customize loan amounts and repayment terms to suit individual needs. Customers can choose to borrow anywhere from $1,000 to $35,000 and select repayment terms that range from 3 to 5 years.

Comprehensive Suite of Financial Services

Here's a brief overview of the services offered by Borrowell:

- Free Credit Score Monitoring: Borrowell provides free credit score monitoring and alerts to help customers stay on top of their credit score and monitor for any changes or errors.

- Personal Loans: Borrowell offers personal loans with competitive interest rates and flexible repayment options, ranging from $1,000 to $35,000.

- Credit Cards: Borrowell has partnered with several credit card providers to offer customers access to a range of credit card options with competitive interest rates and rewards programs.

- Financial Education: Borrowell provides customers with access to a range of financial education resources, including articles, blog posts, and guides, to help them improve their financial literacy and make better financial decisions.

- Credit Coaching: Borrowell offers personalized credit coaching services to help customers improve their credit score and manage their debt more effectively.

Overall, Borrowell's services are designed to provide Canadians with a range of financial solutions to help them achieve their financial goals, whether they need to borrow money, monitor their credit score, or improve their financial literacy.

| Services by Borrowell | Description |

| Free Credit Score | Provides access to your free Equifax credit score, which is updated monthly. |

| Credit Monitoring | Notifies you via email if there are any significant changes to your credit report, including inquiries, new accounts, and delinquencies. |

| Personalized Credit Coaching | Offers personalized advice on how to improve your credit score and maintain good credit health. |

| Loan and Credit Card Marketplace | Provides access to a variety of loan and credit card options, including personal loans, mortgages, and credit cards. |

| Loan Pre-Approval | Offers pre-approval for personal loans, allowing you to see what loan options are available to you without impacting your credit score. |

| Credit Education Resources | Provides a range of educational resources on credit and personal finance, including articles, videos, and webinars. |

| Investment Monitoring | Provides a free portfolio analysis and investment recommendations based on your risk tolerance and investment goals. |

A Step-by-Step Guide To Get You Started

Getting started with Borrowell is quick and easy! Here are the steps you can follow:

- Create an account: To get started with Borrowell, you'll need to create an account on their website. You'll need to provide some basic personal information, including your name, address, and date of birth.

- Check your credit score: Once you've created an account, you can check your credit score for free. Borrowell provides access to your Equifax credit score and report, which can help you understand your creditworthiness and identify any areas for improvement.

- Apply for a loan or credit card: If you're interested in applying for a loan or credit card, you can do so through your Borrowell account. You'll need to provide some additional information, including your income and employment details, and you may be asked to provide documentation to verify your information.

- Review your offers: Once you've submitted your application, Borrowell will provide you with personalized loan or credit card offers based on your creditworthiness and other factors. You can review these offers and select the one that best meets your needs.

- Receive your funds or credit card: If you're approved for a loan, your funds will be deposited into your bank account within a few business days. If you're approved for a credit card, you'll receive your card in the mail within a few weeks.

Overall, getting started with Borrowell is a simple and straightforward process, and their user-friendly online platform makes it easy to apply for a loan or credit card and manage your finances.

Conclusion

In conclusion, Borrowell is a reliable and reputable company that allows you to manage your finances with ease. From their straightforward and fast loan application process to their wealth of financial information, Borrowell makes it easier than ever for Canadians to access the money they need when they need it. With competitive interest rates and a commitment to customer service excellence, Borrowell is an excellent choice for anyone looking for a loan or credit monitoring solution.